dekalb county tax assessor property

View an Example Taxcard. Property Tax Assessors Duties.

Dekalb County Tax Commissioner S Office Facebook

March 25 2022 You may begin by choosing a search method below.

. DeKalb County Tax Commissioner Collections Division PO Box 117545 Atlanta GA 30368-7545. Locate all taxable property in the County and identify the ownership. CURRENT YEAR PAYMENTS.

Search Any Address 2. The regular homestead exemption is for taxpayers under 65 years old and applies to State and County Single-family owner-occupied property. DEKALB COUNTY BEACON GIS MAPS TAX ASSESSMENT INFO The is no registration required and all information listed is public data pulled directly from our in-office software.

You can visit their website for more information regarding property appraisal in DeKalb County. The assessor determines the value of all property in the county whether real personal or mixed including mineral rights leaseholds and all other. DeKalb County Property Tax Assessor 732 S.

Ad Uncover Available Property Tax Data By Searching Any Address. Establish a taxable value for all property subject to property. The Property Appraisal Assessment.

We Provide Homeowner Data Including Property Tax Liens Deeds More. The DeKalb County Board of Assessors is the agency charged with the responsibility of establishing the fair market value of property for ad valorem taxation purposes. To perform a search on Property Information within DeKalb County.

DeKalb County Assessment Rolls Report Link httpstaxcommissionerdekalbcountygagovPropertyAppraisalrealSearchasp Search DeKalb. Partial Owner Name eg. DeKalb County Property Appraisal.

It is a privilege to serve you. 18 297 02 003. For additional information you may call the Revenue Commissioners Office at 256 845-8515 between the hours of 800 am.

Congress Boulevard Room 104 Smithville TN 37166 DeKalb County Assessor Phone Number 615 597. DeKalb County residents can sign up to receive Property Tax statements by email. 3124 chamblee dunwoody rd.

Connect To The People Places In Your Neighborhood Beyond. Compass DeKalb County Online Map Search. Address 123 Main No St Dr Rdetc Partial Parcel ID Real Estate 12 123.

Property tax information last updated. Greenleaf investment partners l021 llc. Return to Property Appraisal.

Property Tax Mailing Address. 1300 Commerce Drive Decatur GA 30030 404-371-2000 311CCCdekalbcountygagov 2019 DeKalb County. The amount is 400000 assessed value on.

WEdge -DeKalb County Property Tax Inquiry and Property Tax Payments. In order to achieve this goal the Chief County Assessment Office serves the resident taxpayers of DeKalb County with assessing their property value in accordance with the Property Tax Code. Personal Property 1234567 Address.

The Property Appraisal Department is responsible for the appraisal and assessment of property. The Assessor has the following basic responsibilities. See Property Records Deeds Owner Info Much More.

DeKalb County Assessor Address. View Property Tax Information. Last name to perform a.

Dekalb County Tax Commissioner S Office Dekalbtaxga Twitter

Dekalb County Property Appraiser

Property Tax Appeal Blog Dekalb County Tax Assessor

Dekalb County Tax Commissioner Reminds Property Owners Of First Installment Deadline Encourages Online Payment Before Sept 30 On Common Ground News 24 7 Local News

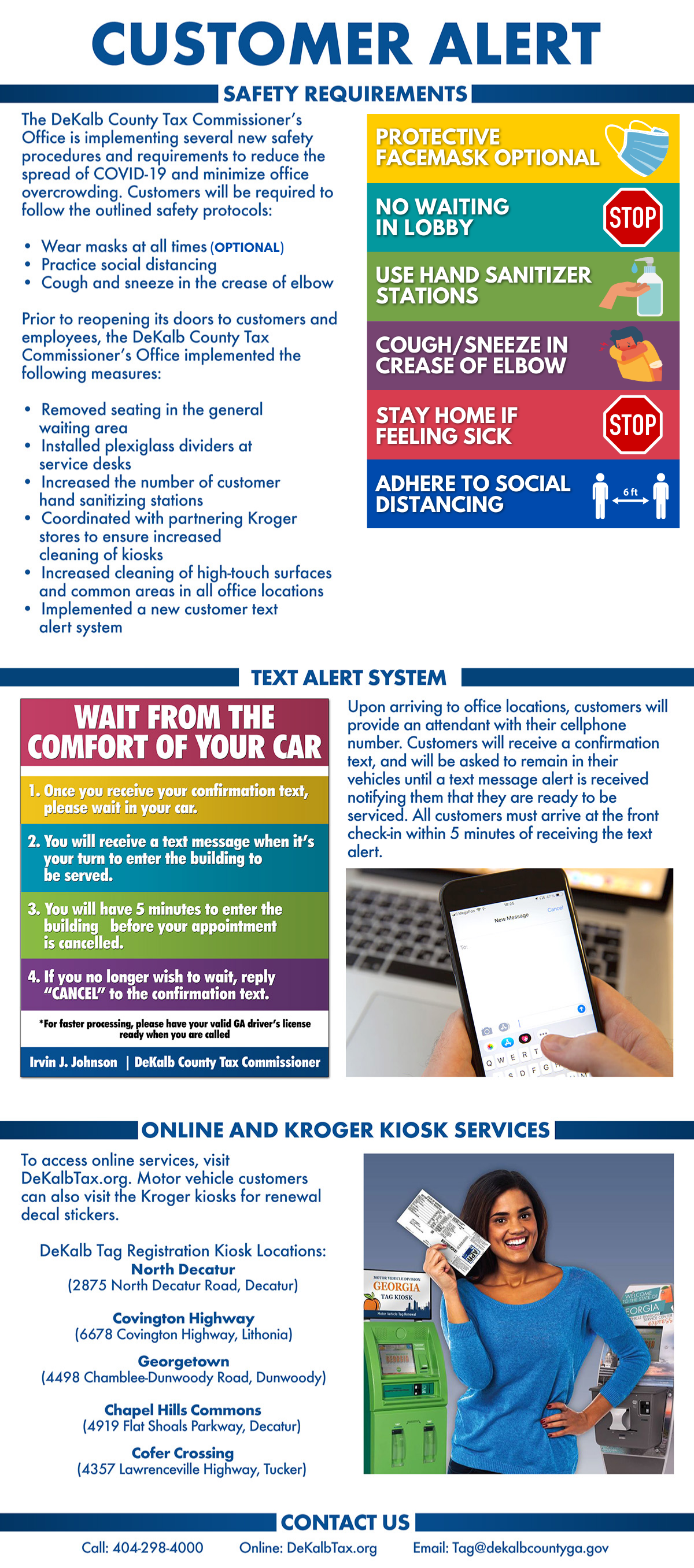

Covid 19 Customer Alert Dekalb Tax Commissioner

Property Tax Payments Dekalb County Ga

Dekalb County Property Tax Bills To Be Mailed Mid August Reporter Newspapers Atlanta Intown

Business Personal Property Dekalb County Revenue Commission

Why You Should Double Check The Assessment By The Dekalb County Tax Assessor

Property Tax Dekalb Tax Commissioner

Things You Should Know Before You File An Appeal With The Dekalb County Tax Assessor

About The Dekalb Seal Dekalb County Ga

State Establishes New Certified Property Tax Rates For Cities And Dekalb County Wjle Radio